Navigating the Labyrinth: A Comprehensive Guide to Getting Auto Insurance

In the modern world, owning and operating a motor vehicle is not just a convenience; for many, it’s a necessity. From daily commutes to road trips, our cars facilitate a significant portion of our lives. However, with the freedom of the open road comes inherent risks. Accidents, thefts, and natural disasters are unfortunate realities that can lead to substantial financial burdens. This is where auto insurance steps in – a crucial financial safety net that not only protects you from unexpected expenses but is also a legal requirement in almost every jurisdiction.

The process of acquiring auto insurance can often feel daunting, a complex labyrinth of jargon, coverage options, and varying price points. This comprehensive guide aims to demystify the process, empowering you with the knowledge and strategies needed to confidently navigate the auto insurance market, secure the right coverage for your needs, and potentially save money in the process.

The Indispensable Role of Auto Insurance

Before delving into the "how-to," it’s essential to understand why auto insurance is so critical. Its importance extends beyond mere legal compliance:

-

Legal Requirement: In nearly all U.S. states and many countries worldwide, carrying a minimum level of auto insurance is mandatory. Driving without it can result in hefty fines, license suspension, vehicle impoundment, and even jail time. These laws are designed to ensure that victims of accidents caused by uninsured drivers have a source of compensation for damages.

-

Financial Protection Against Liability: If you are at fault in an accident, you could be held legally and financially responsible for the other party’s bodily injuries and property damage. Without liability insurance, you could face lawsuits that could lead to devastating out-of-pocket expenses, wage garnishment, and even the loss of personal assets.

-

Protection for Your Vehicle: Accidents, theft, vandalism, and natural disasters can all inflict significant damage on your vehicle. Coverage options like collision and comprehensive insurance protect your investment, ensuring that repairs or replacement costs don’t cripple your finances.

-

Medical Expense Coverage: Accidents often result in injuries, which can lead to substantial medical bills. Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage can help cover these costs, regardless of who was at fault.

-

Peace of Mind: Knowing you’re financially protected against the unpredictable nature of the road provides invaluable peace of mind, allowing you to drive with confidence.

Decoding Auto Insurance Coverage Types

Understanding the various types of auto insurance coverage is the cornerstone of making informed decisions. Policies are typically a combination of these coverages, each addressing a specific risk.

1. Liability Coverage

This is the most fundamental and universally required type of auto insurance. It protects other people if you are at fault in an accident. Liability coverage typically consists of two main components:

- Bodily Injury (BI) Liability: Covers medical expenses, lost wages, and pain and suffering for anyone injured in an accident you cause. It’s usually expressed as two numbers, e.g., $25,000/$50,000. The first number ($25,000) is the maximum amount the policy will pay per person for injuries, and the second ($50,000) is the maximum amount the policy will pay for all injuries in a single accident.

- Property Damage (PD) Liability: Covers damage to another person’s property (e.g., their vehicle, fence, building) if you are at fault. This is the third number in the common liability format, e.g., $25,000/$50,000/$25,000. The $25,000 here represents the maximum amount the policy will pay for property damage per accident.

Recommendation: While states mandate minimum liability limits, these are often insufficient to cover severe accidents. Experts generally recommend carrying significantly higher liability limits (e.g., $100,000/$300,000/$100,000 or even higher) to protect your assets. An umbrella policy can also provide additional liability coverage above your auto and home policies.

2. Collision Coverage

This coverage pays for damage to your vehicle resulting from a collision with another vehicle or object (e.g., a tree, pole, guardrail), regardless of who is at fault. It also covers damage from rollovers. Collision coverage is usually optional if you own your car outright, but it’s typically required by lenders if you have a car loan or lease.

- Deductible: Collision coverage comes with a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Common deductibles range from $250 to $1,000 or more. A higher deductible typically results in a lower premium.

3. Comprehensive Coverage

Also known as "Other Than Collision" coverage, comprehensive insurance pays for damage to your vehicle caused by events other than collisions. These include:

- Theft

- Vandalism

- Fire

- Falling objects (e.g., tree branches)

- Natural disasters (e.g., hail, floods, hurricanes, earthquakes)

- Striking an animal

- Glass breakage

Like collision coverage, comprehensive coverage usually has a deductible and is often required by lenders for financed or leased vehicles.

4. Uninsured/Underinsured Motorist (UM/UIM) Coverage

This is a critically important, yet often overlooked, coverage. It protects you if you are involved in an accident with a driver who either has no insurance (uninsured) or insufficient insurance (underinsured) to cover your damages.

- Uninsured Motorist Bodily Injury (UMBI): Pays for your medical expenses, lost wages, and pain and suffering if an uninsured driver injures you.

- Uninsured Motorist Property Damage (UMPD): Pays for damages to your vehicle if an uninsured driver hits you. (Note: Some states may not offer UMPD, or it may have a specific deductible).

- Underinsured Motorist (UIM): Kicks in when the at-fault driver has insurance, but their policy limits are not enough to cover the full extent of your injuries or damages. Your UIM coverage then pays the difference up to your policy limit.

Recommendation: Given the significant number of uninsured drivers on the road, UM/UIM coverage is highly recommended, even in states where it’s optional.

5. Medical Payments (MedPay) / Personal Injury Protection (PIP)

These coverages help pay for medical expenses for you and your passengers, regardless of who was at fault for the accident.

- Medical Payments (MedPay): Covers medical bills, hospital stays, and sometimes funeral expenses for you and your passengers injured in an accident. It’s often secondary to your health insurance but can cover deductibles or co-pays.

- Personal Injury Protection (PIP): More comprehensive than MedPay, PIP covers medical expenses, lost wages, and essential services (like childcare if you’re injured and can’t perform duties) for you and your passengers. PIP is mandatory in "no-fault" states, where each driver’s own insurance pays for their medical expenses regardless of fault, up to a certain limit.

6. Additional Coverages (Optional Enhancements)

Many insurers offer a range of optional coverages that can be added to your policy for enhanced protection:

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after a covered accident.

- Roadside Assistance: Provides services like towing, jump-starts, tire changes, and fuel delivery if your car breaks down.

- Gap Insurance: If your financed or leased car is totaled, gap insurance covers the "gap" between the actual cash value (ACV) your collision/comprehensive policy pays and the remaining balance on your loan or lease.

- New Car Replacement: For new vehicles, this coverage replaces your totaled car with a brand new one of the same make and model, rather than just paying its depreciated actual cash value.

- Custom Parts and Equipment: Covers aftermarket modifications or custom parts that aren’t typically covered by standard comprehensive/collision.

- Original Equipment Manufacturer (OEM) Parts: Ensures that if your car needs repairs, it will be fixed with brand-new parts from the original manufacturer, rather than aftermarket or used parts.

- Glass Coverage: Some policies offer full glass coverage with no deductible, even if your comprehensive deductible is higher.

Factors Influencing Your Auto Insurance Premiums

Insurance premiums are not arbitrary; they are meticulously calculated based on a multitude of risk factors. Understanding these factors can help you anticipate costs and identify areas where you might save money.

-

Driver-Related Factors:

- Driving Record: This is arguably the most significant factor. Accidents (especially at-fault), speeding tickets, DUIs, and other traffic violations will almost certainly lead to higher premiums. A clean driving record is your best friend.

- Age and Experience: Younger, less experienced drivers (especially teenagers) typically pay the highest rates due to a higher statistical likelihood of accidents. Rates tend to decrease as drivers gain experience and mature, usually leveling off in their 20s or 30s.

- Gender: In some states (though not all, due to regulatory changes), gender can be a factor, with young male drivers sometimes paying more than young female drivers.

- Credit Score (where permitted): In many states, insurers use an "insurance score" derived from your credit history. A higher credit score often correlates with lower premiums, as statistical data suggests individuals with better credit tend to file fewer claims.

- Marital Status: Married individuals often receive lower rates, as they are statistically considered less risky drivers.

- Occupation and Education: Some insurers offer discounts for certain professions (e.g., teachers, engineers) or for higher education levels, as these groups may be perceived as more responsible.

-

Vehicle-Related Factors:

- Make, Model, and Year: Certain vehicles are more expensive to insure. Sports cars, luxury vehicles, and those with high theft rates typically cost more. Vehicles with high safety ratings and features (e.g., anti-lock brakes, airbags, stability control) may qualify for discounts.

- Cost of Repair/Replacement: Cars with expensive parts or specialized technology that are costly to repair will have higher collision and comprehensive premiums.

- Safety Features: Advanced driver-assistance systems (ADAS) like automatic emergency braking, lane-keeping assist, and blind-spot monitoring can sometimes lead to discounts, though sometimes they can also increase repair costs if damaged.

- Anti-Theft Devices: Alarms, immobilizers, and GPS tracking systems can reduce comprehensive premiums.

-

Usage-Related Factors:

- Annual Mileage: Drivers who drive fewer miles generally pay less because they have less exposure to risk.

- Primary Use: Commuting to work, business use, or pleasure driving will affect rates. Commuters often pay more than those who drive only for pleasure.

-

Location-Related Factors:

- Zip Code: Urban areas with higher traffic density, accident rates, theft rates, and vandalism often have higher premiums than rural areas.

- Garaging Location: Where you park your car overnight (e.g., in a secure garage vs. on the street) can influence rates.

-

Coverage-Related Factors:

- Coverage Limits: Higher liability limits and more comprehensive coverage options naturally lead to higher premiums.

- Deductibles: As mentioned, choosing a higher deductible for collision and comprehensive coverage will lower your premium.

The Step-by-Step Process of Securing Auto Insurance

Acquiring auto insurance doesn’t have to be a bewildering experience. By following a structured approach, you can efficiently find the coverage that best suits your needs and budget.

Step 1: Gather Necessary Information

Before you start getting quotes, have all the relevant details ready. This will streamline the process and ensure accurate quotes:

- Personal Information: Name, address, date of birth, marital status, occupation, education level, driver’s license number for all drivers to be insured.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), odometer reading, safety features, anti-theft devices.

- Driving History: Details of any accidents (date, type, fault), traffic violations (date, type), and claims filed in the past 3-5 years for all drivers.

- Current Insurance Information (if applicable): Your current policy details, including coverage limits and expiration date.

- Financial Information: While not always required upfront for a quote, be prepared to provide payment details once you select a policy.

Step 2: Determine Your Coverage Needs

This is a critical introspective step. Don’t just default to the state minimums. Consider:

- Your Assets: How much financial protection do you need to safeguard your savings, home, and future earnings if you’re at fault in a severe accident? This will guide your liability limits.

- Your Vehicle’s Value: If your car is old and has low market value, collision and comprehensive coverage might not be cost-effective. The cost of the premium and deductible might outweigh the car’s actual cash value. For newer or more valuable cars, these coverages are essential.

- Your Financial Situation: How much can you realistically afford for deductibles? Can you comfortably pay a $1,000 deductible out of pocket if you have an accident? If not, a lower deductible might be better, even if it means a slightly higher premium.

- State Requirements: Understand the minimum liability requirements in your state.

- Lender Requirements: If you have a car loan or lease, your lender will dictate minimum collision and comprehensive coverage levels.

Step 3: Research and Compare Insurers

The auto insurance market is highly competitive, with a wide array of providers. Don’t settle for the first quote you receive.

- Online Comparison Sites: Websites like Insurify, The Zebra, or QuoteWizard allow you to enter your information once and receive multiple quotes from different insurers. While convenient, they might not include all insurers, and direct quotes from company websites can sometimes differ.

- Direct Insurers: Companies like GEICO, Progressive, State Farm, Allstate, Farmers, Liberty Mutual, USAA (for military members/families), and many regional providers offer quotes directly through their websites or call centers.

- Independent Agents: These agents work with multiple insurance companies and can shop around on your behalf to find the best rates and coverage. They can offer personalized advice and often have access to insurers you might not find through direct online searches.

- Captive Agents: These agents work exclusively for one insurance company (e.g., a State Farm agent). While they can only offer that company’s products, they often provide in-depth knowledge of their specific policies and strong customer service.

- Financial Strength Ratings: Check ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s. A strong financial rating indicates an insurer’s ability to pay out claims.

- Customer Service Reviews: Look at online reviews (e.g., JD Power, Consumer Reports, BBB) to gauge customer satisfaction regarding claims handling, communication, and overall experience. A low premium isn’t worth it if the claims process is a nightmare.

Step 4: Obtain Multiple Quotes

Contact at least 3-5 different insurers or agents. When getting quotes:

- Provide Consistent Information: Ensure you give the exact same information (coverage limits, deductibles, driver details, vehicle details) to each insurer to get truly comparable quotes.

- Ask About Discounts: Don’t assume all discounts are automatically applied. Proactively ask about every discount you think you might qualify for.

- Clarify Coverage: If a quote seems unusually low, double-check the coverage limits and deductibles to ensure they match what you requested.

Step 5: Compare Quotes Thoroughly

Don’t just look at the bottom-line premium. A professional comparison involves a deeper dive:

- Coverage Limits and Types: Ensure each quote provides the exact same liability limits, collision/comprehensive deductibles, and any optional coverages (UM/UIM, rental, roadside, etc.) you’ve decided you need.

- Deductibles: Verify that deductibles for collision and comprehensive are consistent across quotes.

- Discounts Applied: See which discounts each insurer has applied. This can reveal why one quote is lower than another.

- Payment Options: Some insurers offer discounts for paying in full, setting up automatic payments, or choosing electronic documents.

- Customer Service Reputation: Revisit your research on customer service and claims handling. A slightly higher premium for an insurer with a stellar reputation might be a worthwhile investment.

- Exclusions and Limitations: Briefly review the policy documents for any unusual exclusions or limitations that might impact your coverage.

Step 6: Make Your Decision and Purchase the Policy

Once you’ve compared and decided on the best option:

- Contact the Insurer: Reach out to the chosen insurer (or your agent) to finalize the purchase.

- Review Policy Details: Before making the payment, carefully review the declarations page, which summarizes your coverage, limits, deductibles, and premium. Ensure everything matches what you discussed and expected.

- Set an Effective Date: Choose a start date for your policy. If you’re switching insurers, ensure there’s no lapse in coverage.

- Provide Payment: Pay your first premium. Many insurers require the first month’s payment (or full payment for a discount) upfront.

- Receive Proof of Insurance: Once purchased, the insurer will provide proof of insurance (ID cards), which you should keep in your vehicle and/or readily accessible on your phone.

Step 7: Maintain and Review Your Policy

Auto insurance isn’t a "set it and forget it" product.

- Annual Reviews: At each renewal, review your policy. Have your needs changed? Are there new discounts available?

- Life Changes: Update your policy whenever there are significant life events (e.g., buying a new car, moving, getting married, adding a new driver like a teenager, changing jobs/commute).

- Shop Around Periodically: Even if you’re happy with your current insurer, it’s wise to get new quotes every 1-3 years to ensure you’re still getting the best rates.

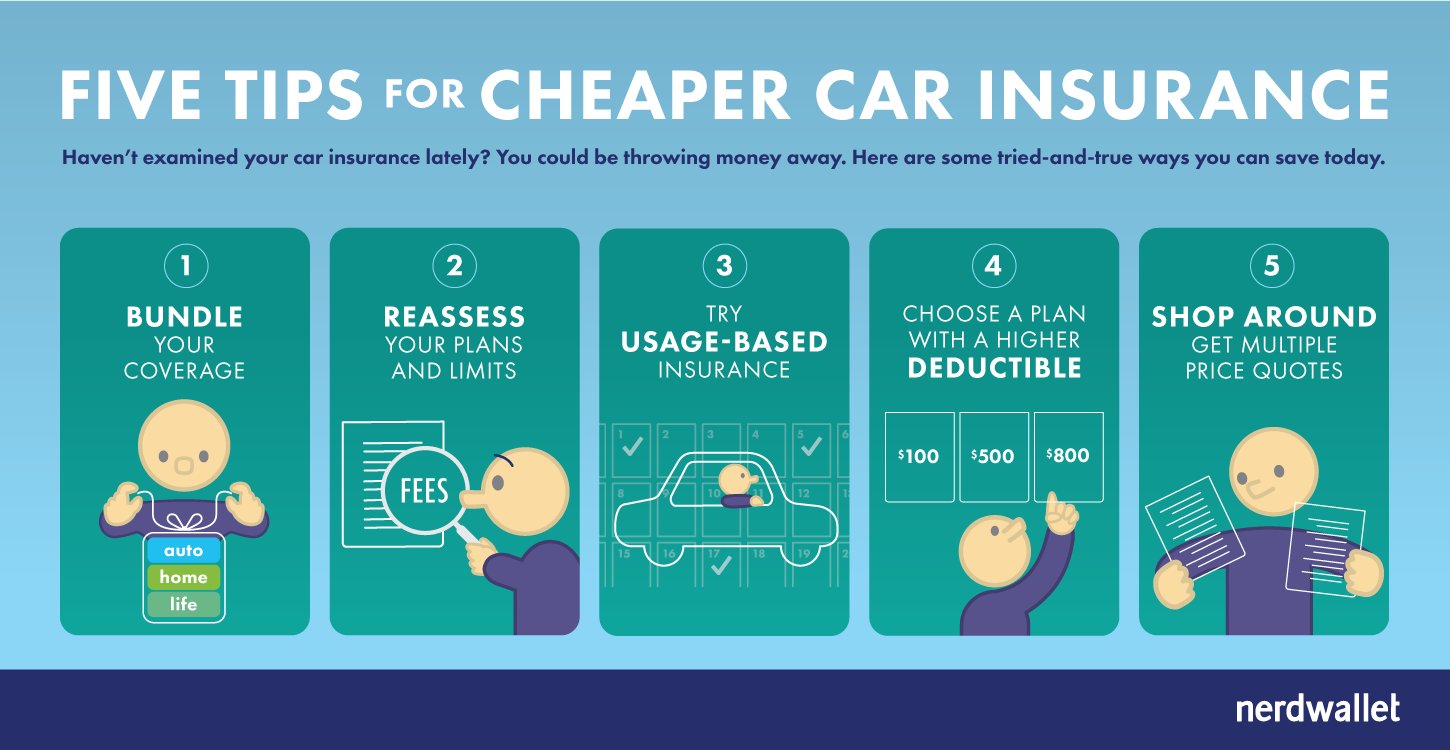

Strategies for Optimizing Your Auto Insurance Costs

While you can’t control all factors influencing your premiums, many strategies can help you lower your costs without sacrificing essential coverage.

-

Leverage All Available Discounts: This is one of the most effective ways to save. Always ask your insurer about:

- Multi-Policy Discount: Bundling your auto and home/renter’s insurance with the same company.

- Good Driver/Accident-Free Discount: For drivers with a clean record over a certain period (e.g., 3-5 years).

- Good Student Discount: For young drivers who maintain a certain GPA.

- Defensive Driving Course Discount: For completing an approved defensive driving course.

- Low Mileage Discount: For drivers who don’t drive many miles annually.

- Anti-Theft Device Discount: For vehicles equipped with alarms or tracking systems.

- New Car Discount: Sometimes offered for newer vehicles with advanced safety features.

- Payment Discounts: For paying in full, setting up automatic payments, or choosing paperless billing.

- Professional/Affinity Discounts: For members of certain organizations, alumni associations, or professions.

- Telematics/Usage-Based Insurance: Programs that monitor your driving habits (speed, braking, mileage) via a device or app. Safe drivers can earn significant discounts.

-

Choose Higher Deductibles: If you have a healthy emergency fund, opting for a higher deductible on your collision and comprehensive coverage can significantly lower your premiums. Just ensure you can comfortably afford to pay that deductible if you need to file a claim.

-

Maintain a Clean Driving Record: This cannot be stressed enough. Avoiding accidents and traffic violations is the single most impactful way to keep your premiums low over the long term.

-

Improve Your Credit Score: In states where it’s permitted, a better credit score often translates to a better insurance score and thus lower premiums.

-

Shop Around Regularly: As mentioned, your circumstances change, and so do insurer rates. What was the best deal a few years ago might not be today. Re-quote every year or two.

-

Consider Dropping Unnecessary Coverage for Older Cars: For very old cars with low market value, the cost of collision and comprehensive coverage might exceed the car’s actual cash value. In such cases, it might be more economical to drop these coverages and self-insure for damage to your own vehicle, focusing instead on robust liability and UM/UIM.

-

Choose the Right Vehicle: Before buying a car, research its insurance costs. Some models are inherently more expensive to insure due to repair costs, theft rates, or performance characteristics.

-

Bundle Policies: Always ask about bundling your auto insurance with other policies you hold (e.g., homeowners, renters, motorcycle) with the same insurer.

-

Increase Security: Installing additional anti-theft devices can sometimes lead to further discounts.

Common Pitfalls to Avoid in Your Auto Insurance Journey

Even with the best intentions, mistakes can happen. Be aware of these common errors:

- Underinsuring: Opting for only the minimum state-mandated liability coverage to save money. This can leave you severely exposed financially if you cause a serious accident.

- Not Comparing Quotes: Assuming your current insurer is the cheapest or that all quotes will be similar. The market is dynamic, and significant savings are often found by shopping around.

- Misrepresenting Information: Providing inaccurate information (e.g., mileage, garaging address, driving history) to get a lower quote. This is insurance fraud and can lead to policy cancellation, denial of claims, and legal repercussions.

- Letting Coverage Lapse: Allowing your policy to expire, even for a short period. This can result in fines, license suspension, and significantly higher premiums when you try to get new insurance, as you’ll be considered a high-risk driver.

- Ignoring Policy Details: Not reading your policy document. It contains critical information about what is and isn’t covered, your responsibilities, and the claims process.

- Focusing Solely on Price: While cost is important, it shouldn’t be the only factor. A cheap policy with poor coverage or an insurer with a terrible claims reputation can cost you more in the long run.

- Failing to Update Your Policy: Not informing your insurer of significant life changes (new car, new address, new driver). This could lead to a claim being denied or your policy being inadequate.

Understanding Your Auto Insurance Policy Document

Once you’ve purchased a policy, it’s crucial to understand the document itself. This is your contract with the insurance company. Key sections typically include:

- Declarations Page: This is the summary page, usually at the front. It lists your name, address, policy number, policy period, covered vehicles, drivers, specific coverages, limits, deductibles, and premiums. This is your go-to page for quick reference.

- Policy Booklet/Jacket: This is the detailed legal document outlining the terms, conditions, definitions, exclusions, and endorsements of your policy.

- Definitions: Explains key terms used throughout the policy (e.g., "covered auto," "insured person," "accident").

- Insuring Agreement: States what the insurer promises to cover.

- Exclusions: Clearly outlines what is not covered by the policy (e.g., intentional acts, damage from racing, wear and tear).

- Conditions: Your responsibilities as the insured, such as promptly reporting accidents, cooperating with the investigation, and paying premiums on time.

- Endorsements: Any amendments or additions to the standard policy that modify coverage.

Take the time to read through your policy. If anything is unclear, don’t hesitate to ask your agent or insurer for clarification.

When to Re-evaluate and Update Your Auto Insurance Policy

Life is dynamic, and your insurance needs will evolve. Regularly reviewing your policy ensures it remains adequate and cost-effective. Key trigger points for review include:

- Buying a New Vehicle: Always get quotes before purchasing a new car, as insurance costs vary widely by make and model.

- Moving to a New Address: Your garaging location significantly impacts rates.

- Getting Married or Divorced: Marital status affects rates, and you’ll need to add or remove spouses from the policy.

- Adding a New Driver (especially a Teenager): Insuring a teen driver is one of the most significant premium increases you’ll face. Explore good student discounts and defensive driving courses.

- Removing a Driver: If a child moves out or a spouse no longer drives, remove them to save money.

- Changing Your Commute or Annual Mileage: If you start working from home or get a job with a shorter commute, your annual mileage might decrease, potentially qualifying you for a discount.

- Major Life Changes: Such as retirement, which might reduce your driving.

- Policy Renewal: Every renewal period is an opportunity to review coverage, check for new discounts, and shop around.

- After an Accident or Violation: Your rates will likely change, so it’s a good time to re-evaluate.

Navigating the Claims Process

Should the unfortunate event of an accident or vehicle damage occur, knowing how to navigate the claims process is vital.

- Safety First: Ensure everyone’s safety. Move to a safe location if possible.

- Contact Authorities: Call the police, especially if there are injuries, significant damage, or if the other driver is uncooperative. A police report can be invaluable.

- Exchange Information: Get contact details, insurance information, driver’s license numbers, and license plate numbers from all parties involved.

- Document the Scene: Take photos of vehicle damage, the accident scene, road conditions, and any relevant surroundings.

- Seek Medical Attention: If injured, prioritize your health and seek medical attention immediately.

- Notify Your Insurer Promptly: Report the claim as soon as possible, ideally within 24 hours. Provide accurate details and be honest.

- Cooperate with the Adjuster: Your insurer will assign a claims adjuster to investigate. Provide all requested documentation, photos, and statements.

- Get Repair Estimates: If your vehicle is damaged, you’ll typically need to get estimates for repairs. Your insurer might have preferred repair shops or allow you to choose your own.

- Understand Your Settlement: Once the investigation is complete, the insurer will offer a settlement based on your policy terms and the damage assessment. Review it carefully before accepting.

Conclusion

Auto insurance is more than just a legal obligation; it’s a critical component of responsible vehicle ownership, offering essential financial protection and invaluable peace of mind. While the journey to securing the right policy can seem intricate, armed with a clear understanding of coverage types, influencing factors, and a methodical approach to shopping, you can navigate the market with confidence.

By taking the time to assess your needs, gather thorough information, compare multiple reputable insurers, and proactively manage your policy, you empower yourself to make informed decisions. Remember, the cheapest policy isn’t always the best, and a robust understanding of your coverage ensures you’re adequately protected when it matters most. Drive safely, stay informed, and enjoy the journey knowing you’re well-covered.