The Evolving Landscape of Insurance in the 21st Century

We will be happy to explore interesting topics related to The Evolving Landscape of Insurance in the 21st Century. Let’s weave interesting information and provide new views to readers.

Insurance, a cornerstone of modern financial security, has undergone a dramatic transformation in recent years. Driven by technological advancements, shifting demographics, and evolving consumer expectations, the insurance industry is facing both unprecedented challenges and exciting opportunities. Understanding the current state of insurance requires a deep dive into the forces shaping its future.

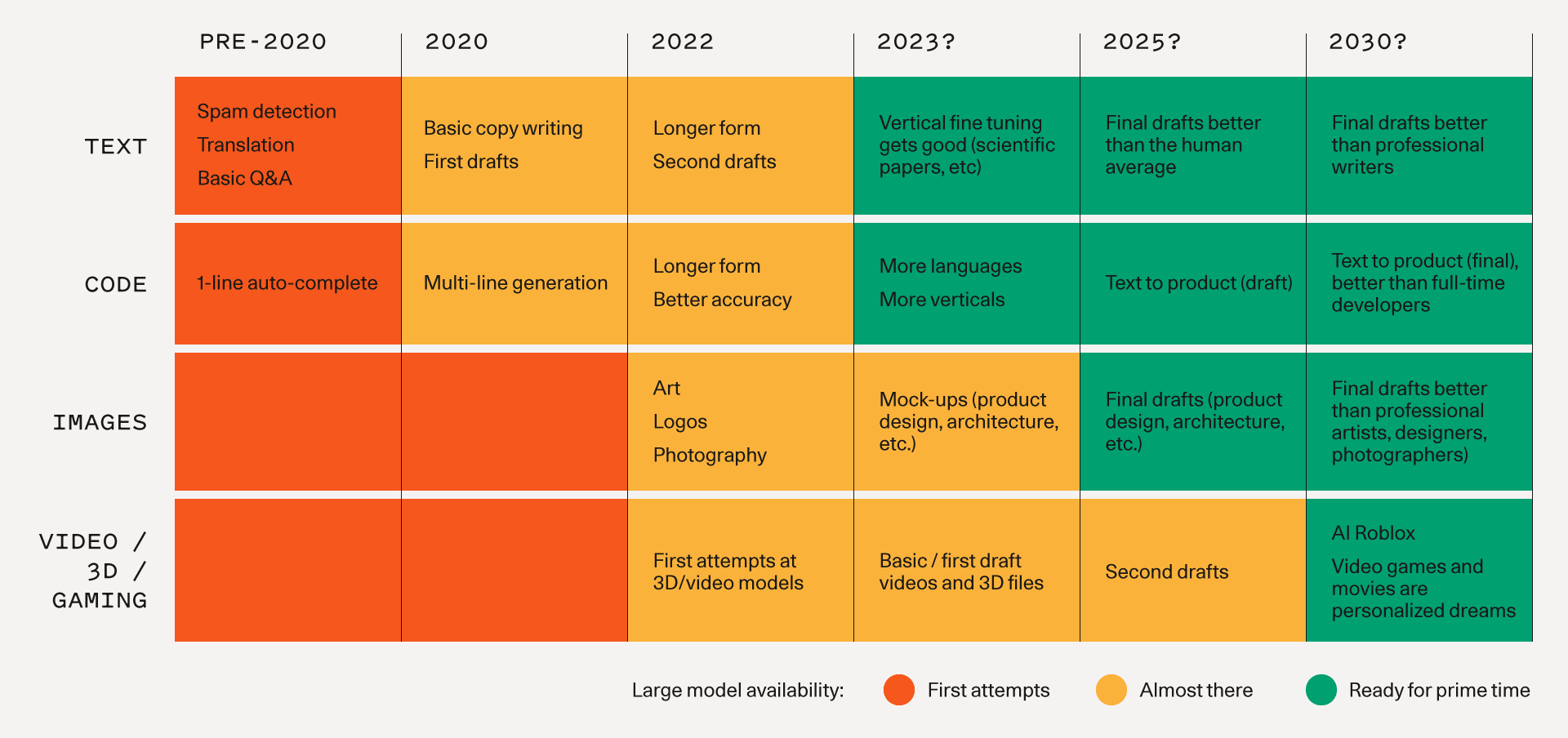

The rise of insurtech, a fusion of insurance and technology, is revolutionizing traditional insurance models. Insurtech companies are leveraging data analytics, artificial intelligence (AI), and the Internet of Things (IoT) to streamline processes, personalize policies, and enhance the customer experience. From automated claims processing to risk assessment powered by machine learning, insurtech is reshaping every aspect of the insurance value chain. This shift is not just about efficiency; it’s about creating more relevant and accessible insurance solutions for a wider range of individuals and businesses.

One of the most significant impacts of insurtech is the ability to offer personalized insurance products. Traditional insurance policies often follow a one-size-fits-all approach, which can be inadequate for individuals with unique needs and risk profiles. By analyzing vast amounts of data, insurtech companies can tailor policies to match specific circumstances, offering customized coverage at competitive prices. This personalization extends to pricing, coverage limits, and even the way claims are handled, resulting in a more satisfying and relevant customer experience.

The integration of IoT devices into insurance is another game-changer. For example, in the auto insurance sector, telematics devices can track driving behavior, providing valuable insights into driver safety. This data can be used to reward safe drivers with lower premiums, while also identifying and addressing risky driving habits. Similarly, in the home insurance sector, smart home devices can detect water leaks, fire hazards, and security breaches, enabling proactive risk mitigation and preventing costly damages.

Cyber insurance has emerged as a critical component of risk management for businesses of all sizes. With the increasing prevalence of cyberattacks and data breaches, companies face significant financial and reputational risks. Cyber insurance policies provide coverage for expenses related to data recovery, legal fees, regulatory fines, and business interruption losses. As the cyber threat landscape continues to evolve, cyber insurance is becoming an indispensable tool for protecting businesses from the devastating consequences of cybercrime.

The COVID-19 pandemic exposed vulnerabilities in the insurance industry and accelerated the adoption of digital solutions. Lockdowns and social distancing measures forced insurers to embrace remote work, online sales, and virtual claims processing. The pandemic also highlighted the importance of business interruption insurance and the need for clear policy language regarding pandemics and other unforeseen events. As a result, insurers are reevaluating their risk models and developing more comprehensive coverage options to address future crises.

Climate change is another major challenge facing the insurance industry. Extreme weather events, such as hurricanes, floods, and wildfires, are becoming more frequent and severe, leading to increased insurance claims and higher premiums. Insurers are working to better understand and quantify the risks associated with climate change, developing innovative risk transfer mechanisms, and promoting sustainable practices to mitigate the impacts of climate change on the insurance industry.

The aging population is also impacting the insurance landscape. As people live longer, they require more healthcare services and long-term care. This is driving demand for health insurance, long-term care insurance, and annuity products. Insurers are developing new products and services to meet the evolving needs of older adults, while also addressing the challenges of affordability and access to care.

The regulatory environment for insurance is constantly evolving. Regulators are focused on protecting consumers, ensuring the solvency of insurers, and promoting fair competition. New regulations are being introduced to address issues such as data privacy, cybersecurity, and climate change. Insurers must stay abreast of these regulatory changes and adapt their business practices to comply with the latest requirements.

Distribution channels for insurance are also changing. While traditional channels, such as agents and brokers, remain important, online channels are gaining increasing traction. Consumers are increasingly researching and purchasing insurance online, using comparison websites and mobile apps. Insurers are investing in digital marketing and customer service to reach consumers through these online channels.

The importance of financial literacy in making informed insurance decisions cannot be overstated. Many individuals lack a basic understanding of insurance concepts and policy terms, making it difficult for them to choose the right coverage. Insurance companies and consumer advocacy groups are working to improve financial literacy by providing educational resources and tools to help consumers make informed decisions about their insurance needs.

The future of insurance will be shaped by a combination of technological innovation, changing demographics, and evolving consumer expectations. Insurers that embrace digital transformation, prioritize customer experience, and adapt to the changing risk landscape will be best positioned for success. The industry will likely see more personalized products, data-driven risk assessment, and seamless digital interactions.

The insurance industry is also increasingly focused on social responsibility. Insurers are investing in initiatives that promote sustainability, diversity, and inclusion. They are also working to address social issues such as poverty, inequality, and climate change. By aligning their business practices with social values, insurers can build trust with customers and contribute to a more sustainable and equitable future.

The rise of the sharing economy, with services like Airbnb and Uber, presents both opportunities and challenges for the insurance industry. Traditional insurance policies may not adequately cover the risks associated with these new business models. Insurers are developing new products and services to address the unique insurance needs of participants in the sharing economy, providing coverage for property damage, liability, and other risks.

The insurance industry is at a pivotal moment. By embracing innovation, adapting to change, and prioritizing customer needs, insurers can continue to play a vital role in protecting individuals and businesses from financial risk. The future of insurance will be defined by its ability to provide relevant, accessible, and affordable coverage in a rapidly changing world.

Frequently Asked Questions (FAQs)

1. What is insurtech and how is it changing the insurance industry?

Insurtech is the use of technology to improve and streamline the insurance process. It involves using data analytics, AI, and IoT to personalize policies, automate claims, and enhance customer experience. This leads to more efficient and accessible insurance solutions.

2. How does climate change impact insurance premiums?

Climate change leads to more frequent and severe extreme weather events, such as hurricanes and floods. This results in increased insurance claims, forcing insurers to raise premiums to cover the higher costs of payouts and manage the increased risk.

3. What is cyber insurance and why is it important for businesses?

Cyber insurance protects businesses from financial losses related to cyberattacks and data breaches. It covers expenses like data recovery, legal fees, regulatory fines, and business interruption, making it crucial for businesses in today’s digital landscape.

4. How can I find the best insurance policy for my needs?

To find the best policy, assess your specific needs and risks, compare quotes from multiple insurers, read policy terms carefully, and consider consulting with an insurance broker. Understanding your requirements and comparing options is key.

5. What is the role of financial literacy in insurance decisions?

Financial literacy is crucial for making informed insurance decisions. It helps individuals understand insurance concepts, policy terms, and risk assessment, enabling them to choose the right coverage that meets their needs and budget effectively.

(Translation to English is not needed as the article is already written in English)

Related Article

- Navigating The Labyrinth: A Comprehensive Guide To Insurance Quotes

- The Intricate World Of Insurance Companies: A Comprehensive Overview

- Navigating The Landscape: Finding The Right Insurance Agency Near You

- Navigating The Labyrinth: A Comprehensive Guide To Insurance Eligibility

- Navigating The Maze: Unveiling The Secrets To Finding Cheap Insurance Quotes

Thus, we hope this article has provided valuable insight into The Evolving Landscape of Insurance in the 21st Century. We thank you for your attention to our article. See you in our next article!